How Fossil Fuels Drive Inflation and Make Life Less Affordable for Canadians

The Bottom Line: Unpacking the future of Canada's oil & gas

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This policy brief is a part of the The Bottom Line series, which digs into the complex questions that will shape Canada's place in future energy markets. (Download PDF)

Summary

-

Fossil fuel prices are volatile and impact not only the price of energy services but also many non-energy items. Energy prices are a key driver in determining the inflation rate but are also the most volatile component of Canada’s overall inflation. From February 2021 to June 2022, energy prices accounted for a third (33%) of Canada’s overall inflation.

-

Oil and gas price shocks are not new, and energy-driven inflation will keep occurring if Canada continues to be dependent on fossil fuels. Fossil fuel price volatility will continue, driven by geopolitical conflicts, climate-related disruptions impacting both supply and demand, and increased integration of regional natural gas markets with global liquified natural gas (LNG) markets.

-

At the same time, the levelized cost of electricity from renewable energy has now dropped below that of fossil fuels, indicating a clear cost savings alongside improvements in efficiency. Recent analysis has estimated that Canada could save up to CAD 15 billion per year in total energy costs by transitioning its electricity grids to net-zero by 2050, saving most Canadian households an average of CAD 1,500 annually in energy costs.

-

Policies that discourage the use of oil and gas (e.g., carbon pricing) and encourage fuel switching and improved efficiency (e.g., funding electric vehicles and heat pumps) will help Canadians save money and insulate the economy from fossil-fuel-driven inflation. Creating favourable investment conditions for renewable energy and enhancing the capacity and flexibility of the electricity grid should be a priority for federal and provincial governments, as these investments are crucial to support electrification and reduce dependency on fossil fuels.

-

Contrary to arguments that climate policy makes life less affordable, it is fossil fuels that keep consumers stuck on an energy price rollercoaster. There will be regional differences in costs for consumers during the transition from fossil fuels to clean energy. It is imperative for governments to recognize this and take measures to mitigate impacts on access and affordability in regions negatively impacted by price changes. The federal government can play a role in helping minimize any potential cost increases for consumers in regions where there is currently strong reliance on fossil fuels for electricity.

Introduction

Public discourse in Canada is currently dominated by concerns about affordability. Canadians have experienced historic inflation and price increases in the most essential areas of life—food, shelter, and energy. However, there is a key element to price inflation that often gets overlooked: the significant impact of oil and gas prices. Canada’s energy use is highly dependent on fossil fuels, meaning that the price of energy services, such as transportation, home heating, and power, are impacted by international fossil fuel markets. Non-energy items, such as food and various durable goods and services, are all impacted by oil and gas price changes.

Price spikes for oil and gas are nothing new, but as climate change worsens, risks to fossil fuel assets and supply chains increase. As global demand for fossil fuels declines, market responses, geopolitics, and possible imbalances in supply and demand could all potentially increase oil and gas price volatility. Transitioning energy systems away from fossil fuels can not only insulate against volatile fossil fuel prices and energy-driven inflation, but it can also reduce energy use and overall emissions. Well-designed climate policy can be a win–win for Canadians, supporting affordability while also building a net-zero economy. Given the importance of energy to price stability, governments should enact policies and foster investment climates that support a transition away from fossil fuel energy dependence.

The Fuel Price Rollercoaster

Fossil fuel prices are known for volatility (see Figure 1). This volatility is largely unavoidable as oil and gas are subject to the boom-and-bust commodity cycle. International conflicts further contribute to this volatility, as demonstrated by ongoing conflicts in the Middle East and Russia’s invasion of Ukraine.

Figure 1. Oil and gas price volatility over time

Historically, natural gas markets have been regional and, as a result, better insulated from global price shocks. However, this is changing due, in part, to the growth of transcontinental and international pipelines for exporting natural gas resources. Increased integration between regional natural gas markets and the global liquified natural gas (LNG) market also means that fluctuations in the latter can impact regional prices. For example, a surge in demand for LNG exports elsewhere in the world (e.g., extreme weather event, geopolitical conflict) could create a price spike in North American gas prices as domestic supply drops to meet export demand. This would mirror the experiences in the United States and Australia, both of which have seen domestic energy bills climb after natural gas exports increased (Chang, 2022; Energy Innovation & Marcacci, 2024).

In Canada, consumer reliance on fossil fuels magnifies the impact that price spikes and supply disruptions have on the economy. In 2022, the main sources of primary energy consumed in Canada were natural gas (38.1%), refined petroleum products (35.0%), followed by electricity (23.5%). Many provinces still rely heavily on fossil fuels for their power production (Canada Electricity Advisory Council, 2024; Canada Energy Regulator [CER], 2023a). While provincial policy and market design drive electricity rates, fossil fuel prices also directly influence the cost of electricity generation.

Mirroring global markets, fossil fuel prices in Canada are susceptible to large fluctuations (Figure 2). Canada’s energy reliance on fossil fuels means that energy prices are the most volatile component of overall inflation in the country by a significant margin, noting it far outstrips goods, foods, services, and shelter by a wide margin both in terms of positive and negative influence on inflation (Figure 3). The impact of energy price volatility is also evident in United States and European Union inflation data (Krahé & Heilmann, 2023; Melodia & Karlsson, 2022), where natural gas, oil, and petroleum products account for approximately 70% of total energy consumption (Energy Information Administration, 2023; Eurostat, 2024).

Figure 2. Fossil fuel price volatility in Canada

Figure 3. Energy price changes compared to overall inflation in Canada

Fossil fuel price volatility is expected to continue and worsen as climate-related disruptions impact infrastructure, supply, and demand (Tumala et al., 2023; Xie et al., 2022). For example, the polar vortex of 2021 that reached as far south as Texas and the Gulf of Mexico brought winter storms to regions not equipped to manage sustained freezing temperatures. Texas’s electricity grid relies heavily on natural gas, but due to frozen equipment, gas transmission was restricted while extreme cold shut down 25 refineries in the Gulf of Mexico region. Increased demand and reduced supply led to gas price spikes in Texas and throughout North America, including Canada.

The Canadian wildfires of 2016 and 2023 also abruptly impacted North American oil prices. In both years, oil prices (West Texas Intermediate) surged due to lowered production levels, although prices fell again when production came back online. Wildfires that disrupt the oilsands can also create price volatility in the other direction. Alberta oilsands operations account for more than 25% of Canadian natural gas demand, and when that demand is disrupted, intra-Alberta natural gas prices drop. For example, the month prior to the 2016 wildfires, intra-Alberta gas traded at CAD 1.08 per gigajoule (G); in May, it dropped to a record low of CAD 0.58 per G before rebounding to CAD 2.77 per G when production recovered.

Alongside the growing risks of climate events, as global demand for fossil fuels declines, market responses and potential imbalances in supply and demand could increase price volatility. Similarly, ongoing geopolitical tensions and lower levels of global cooperation increase the risk of market disruptions and price shocks. Shoring up investment in reliable, efficient, and low-cost energy sources is essential to mitigate the impact of inevitable global fossil fuel price fluctuations.

Increasing Affordability With Clean Energy Transition

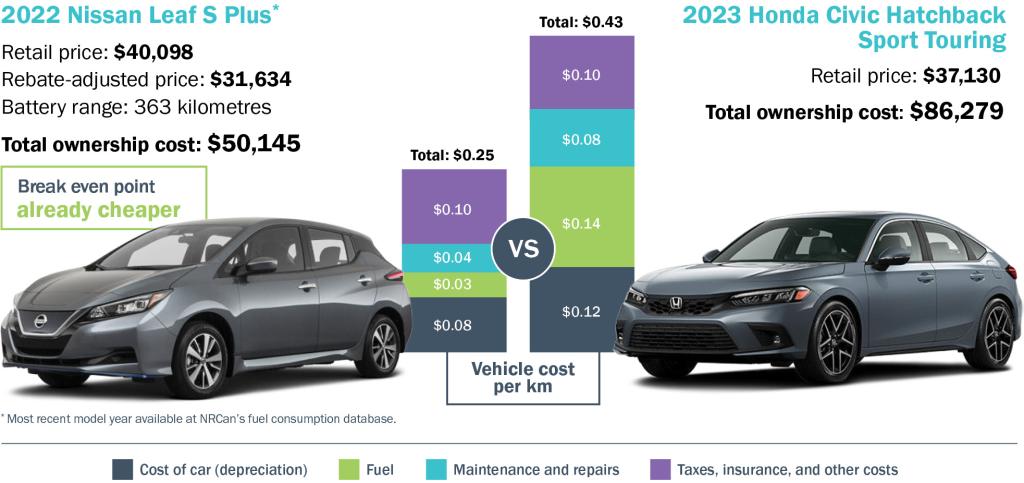

Canada can mitigate future inflation and help make life more affordable for Canadians by supporting a transition away from fossil fuels. In fact, putting the global energy system on a path to net-zero by 2050 could reduce energy operating costs by more than half by 2035. There is opportunity to lower energy costs by reducing the overall amount of energy used through more energy efficient technologies or by changing behaviour (e.g., driving less). Electrification of transportation, heating, and cooling can also save money. This is in part because electric vehicles and heat pumps provide significant efficiency gains over their fossil fuel counterparts—they use less energy to provide the same service. Therefore, government policies that support and incentivize fuel switching, energy efficiency, and changes in behaviour will help smooth and accelerate the transition away from fossil fuels.

Options for cheaper and cleaner energy are reliant on the availability of infrastructure and services such as efficient public transportation, electric vehicle charging infrastructure, and clean, reliable electricity supply. Although significant investment is required to build supportive infrastructure and services, it is a long-term investment that can both boost Canada’s economy and lower the costs that Canadians pay for the services they need. It is also a prudent investment as the costs of clean energy are falling below the costs of fossil fuel energy and are expected to continue falling.

Conclusion

Overdependence on fossil fuels, which are volatile and tend toward high costs, is a problem for Canadian consumers, inflation, and affordability. Record inflation has been driven in large part by oil and gas price increases that have spilled over into other areas of the economy sensitive to energy inputs. By reducing its dependence on fossil fuels, Canada can fight climate change and inflation in a way that supports affordability, shielding consumers from energy price fluctuations by transitioning toward the use of clean and efficient energy sources that have lower and more stable prices.

Governments have a role to play to strategically discourage the use of fossil fuels through policies such as carbon pricing, fuel taxation, and fossil fuel subsidy reform. By doing so, they can generate revenue to further support efforts that enhance affordability and incentivize cost-saving by switching away from fossil fuels and the resulting energy price fluctuations. Contrary to arguments that climate policy makes life less affordable, it is fossil fuels that keep consumers stuck on an energy price rollercoaster. Renewable and electrified energy sources are not only good for the climate, but they also save people money through lower costs and improved efficiency. It is incumbent on governments to champion policies that expedite the transition to more affordable, efficient, and clean energy in a way that focuses on affordability for Canadians, now and for the future.

A full list of references can be found here.

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This publication is a part of The Bottom Line policy brief series, which digs into the complex questions that will shape Canada's place in future energy markets.

You might also be interested in

Volatile Costs of Fossil Fuel Energy were a Key Driver of Recent Record Inflation and Continue to Impact Affordability

New report takes closer look at how Canada’s dependence on fossil fuels impacts energy costs and prices of essentials such as transportation, home heating, and housing.

Why Liquefied Natural Gas Expansion in Canada Is Not Worth the Risk

An analysis of the economic and environmental risks of liquified natural gas expansion in Canada.

New Report Highlights Economic and Environmental Costs of Canada’s LNG Expansion

New report explains how LNG expansion will not only hamper Canada’s progress toward its climate goals but also create challenges for the economy in the long term.

IISD Annual Report 2022–2023

At IISD, we’ve been working for more than three decades to create a world where people and the planet thrive. As the climate crisis unfolds on our doorsteps and irreversible tipping points loom, our team has been focused more than ever on impact.