Why Carbon Capture and Storage Is Not a Net-Zero Solution for Canada’s Oil and Gas Sector

The Bottom Line: Unpacking the future of Canada's oil & gas

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This policy brief is part six of The Bottom Line series, which digs into the complex questions that will shape Canada's place in future energy markets. (Download PDF)

Summary

- Reducing emissions from Canada’s oil and gas production is a priority, yet it presents unique challenges. Industry representatives consider carbon capture and storage (CCS) to be the sector’s primary emission reduction solution, but there is a lack of evidence on the efficacy of this approach and its consistency with Canada’s net-zero commitment.

- There are seven CCS projects currently operating in Canada, mostly in the oil and gas sector, capturing about 0.5% of national emissions. CCS in oil and gas production does not address emissions from downstream uses of those fuels. Captured carbon is used predominantly for enhanced oil recovery to facilitate additional oil extraction.

- CCS in the oil and gas sector is expensive—as much as CAD 200 per tonne for currently operating projects—as well as energy intensive, slow to implement, and unproven at scale, making it a poor strategy for decarbonizing oil and gas production, as evidenced by the track record of the technology in Canada and globally.

- Despite this, the federal government provides substantial support for CCS, having committed at least CAD 9.1 billion public dollars to date, alongside CAD 3.8 billion from the governments of Alberta and Saskatchewan. Industry is seeking further public funding. The U.S. Inflation Reduction Act (IRA), by comparison, offers much less financial support for CCS than what is already on the table in Canada: by 2030, Canada’s CCS Investment Tax Credit is estimated to provide double the subsidy amount offered via the IRA to CCS.

- Investing in CCS is a risky investment for taxpayers and comes with a significant opportunity cost for near-term, more cost-effective solutions.

Banner Image Credit: Alberta Newsroom

As Canada seeks to lower its emissions by 2030 and reach net-zero by mid-century, the oil and gas sector—the country’s largest and fastest-growing source of emissions—faces the challenge of decarbonizing production. CCS is one of the main tools proposed by industry and government to meet this challenge.

In this sector, CCS is the process by which emissions created during oil and gas production, refining, and upgrading are sequestered underground or used in further industrial processes (the latter is known as carbon capture, utilization, and storage [CCUS])—this report uses CCS as a shorthand that includes CCUS. Both industry and government have emphasized the important role they believe CCS will play in reducing oil and gas sector emissions, with the aim of reaching net-zero production by mid-century. Given the emphasis placed on CCS as an emissions-reduction solution and the scale of public investment directed toward it, the costs and benefits of this approach must be closely evaluated.

The application of CCS to oil and gas production merits individual assessment given the unique challenges facing this industry in the transition to net-zero and is therefore the sole focus of this brief.

Carbon Capture and Storage in Canada’s Oil and Gas Sector

CCS in the oil and gas sector is used to lower emissions from production, and therefore covers only one side of the equation, representing about 15% of those fuels’ total life-cycle emissions. Production-side CCS does not reduce emissions from the end uses of oil and gas, which represent the largest share of life-cycle oil and gas emissions. Furthermore, most commercial-scale CCS projects in Canada use the captured carbon to boost the production of oil and gas through a process called enhanced oil recovery (EOR), injecting carbon dioxide (CO2) into declining oil fields to increase production, thereby creating new emissions (see Table 1).

There are currently seven operational CCS projects in Canada, five of which are related to the oil and gas sector (Table 1). A recent example is the Alberta Carbon Trunk Line, a major network of pipelines for transporting CO2 captured from a refinery and an ammonia plant to declining oil fields in Alberta, where it is used to enhance oil recovery by “revitalizing” old oil fields and “extending the life of mature fields by several decades”. The CCS project at the North West Sturgeon Refinery had a similar goal. Another example is Shell’s Quest project, which has been operating since 2015 and produces blue hydrogen (hydrogen produced from natural gas with CCS) that is then used to upgrade bitumen into synthetic crude. Additional blue hydrogen projects are in the works, such as Suncor and ATCO’s joint venture to build a CAD 4 billion plant to produce blue hydrogen—65% of which would be used in Suncor’s Edmonton refinery.

The primary potential application of CCS in Canada’s oilsands would be capturing emissions from natural gas combustion (used to generate steam to facilitate bitumen extraction or upgrading). Yet this form of emissions capture is very nascent. While about 65%–70% of CCS projects globally capture emissions from natural gas processing (IEA, 2021b; Robertson & Mousavian, 2022), in August 2022, Entropy’s Glacier Gas Plant in Alberta may have become the first commercial project in the world to capture gas combustion emissions.

One noteworthy downstream CCS project is Boundary Dam, the first commercial-scale CCS project in the country. Operating since 2014, Boundary Dam captures CO2 from a coal-fired power station in Saskatchewan and redirects it to increase production through EOR in the Weyburn oil fields. It had an original target of capturing 90% of the coal plant’s total emissions; however, it has never achieved this rate, and a spokesperson for the project has called the target unrealistic. On average, the project captures approximately 50% of the plant’s emissions.

Publicly available data on capture rates is limited due to the lack of industry transparency and independent monitoring. There are seven CCS projects currently operating in Canada, mostly in the oil and gas sector, capturing about 0.5% of national emissions. Based on available data, projects operating in the oil and gas sector in Canada capture approximately 2.7 million tonnes of CO2 equivalent per year (Mtpa). This is approximately 1.3% of the sector’s pre-pandemic emissions and 2.6% of the reductions needed for the sector to contribute a fair share to the national 2030 target of a 40%–45% reduction below 2005 levels.

Further, approximately 70% of the carbon captured in existing CCS facilities in Canada is used to increase the production of aging oil fields through EOR. CCS is, therefore, facilitating continued Canadian oil and gas production—which the industry expects to grow by nearly 30% above 2020 levels by the end of the decade.

The poor track record of CCS in Canada is part of a broader trend. According to the Global CCS Institute (2022), the global growth of carbon captured by commercially operating CCS facilities has been much slower than anticipated. As of September 2022, only 30 commercial CCS projects are operating across all sectors around the world, capturing 42.5 Mtpa. This falls far short of the IEA’s (2009) previous target of 300 Mtpa by 2020. Most proposed projects have been withdrawn: of the 149 CCS projects anticipated to be storing carbon by 2020, over 100 were cancelled or placed on indefinite hold (Abdulla et al., 2020; Wang et al., 2021). In the United States, despite significant industry and government investment in the technology, more than 80% of proposed CCS projects have failed to become operational due to high costs, low technological readiness, the lack of a credible financial return, and dependence on government incentives that are withdrawn. Of those projects that are operating globally, 73% of the carbon captured is used for EOR.

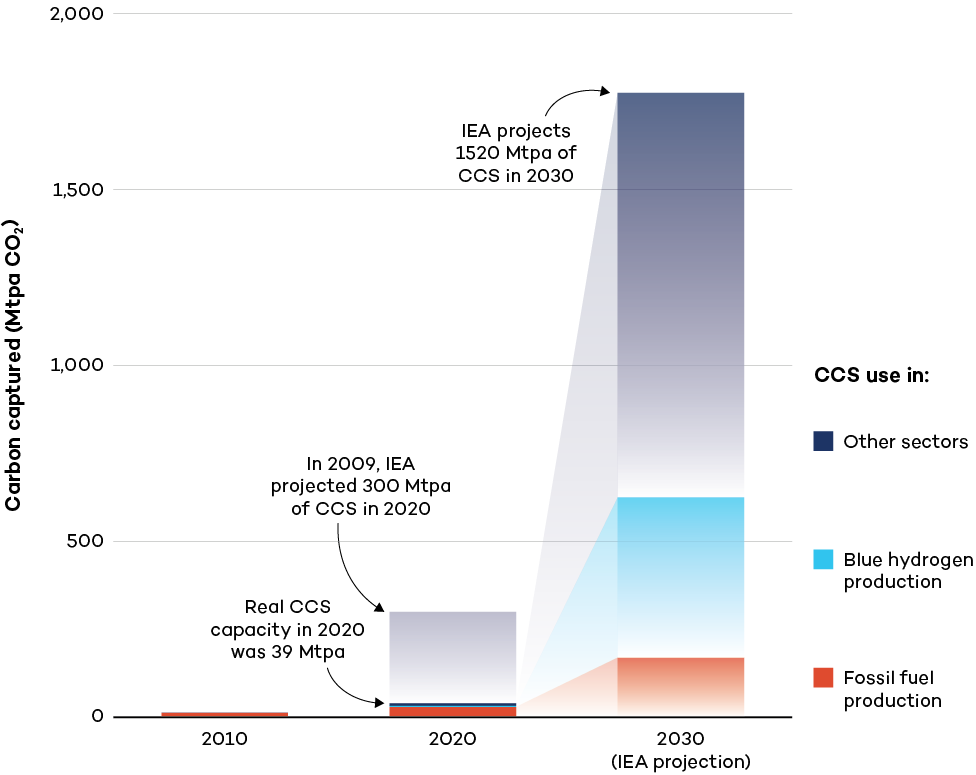

Put simply, proponents of CCS have repeatedly over-promised on the technology’s ability to reduce emissions, and CCS projects have under-delivered. As depicted in Figure 1, the IEA projects that CCS capacity in the oil and gas sector specifically will grow from 30 Mtpa in 2020 to 170 Mtpa by 2030 and that overall global CCS capacity across sectors will increase by 400% in this period. Yet so far—despite significant investment and application since the early 1970s—CCS has fallen far short of its anticipated progress.

Figure 1. Global CCS capacity historically and projected under the IEA net-zero scenario

Despite the disappointing performance of CCS to date in Canada and internationally, Canadian oil and gas companies continue to propose new CCS projects as the primary measure of reducing their emissions. The Pathways Alliance—an organization of six companies that operate 95% of oilsands production—has budgeted two thirds of its recent emissions reduction investment for CCS. The companies propose to spend CAD 16.5 billion by 2030 on the first phase of a CCS project that aims to collect an estimated 10 MT annually of CO2 from 20 oilsands facilities and transport it to be stored underground near Cold Lake, Alberta. Over CAD 7 billion of the cost would be covered by taxpayers through a federal tax credit for CCS investment, and the Alliance has indicated their investment is contingent on even more government support.

Yet even if this project were to proceed and successfully achieve the target capture rate, it would represent only a small fraction of the emissions reductions required by the oil and gas sector to align with national commitments.

Energy and Capital Intensity of Carbon Capture and Storage

CCS is both energy and capital intensive. The greatest amount of energy is required for the capture and compression of carbon, with additional amounts needed for transportation and storage. Capture and compression alone require 330–420 kWh per tonne of CO2 captured. CCS projects increase the energy demand of the facility they capture carbon from by 15%–25% on average, which stands to increase emissions given that the energy used to capture CO2 is often natural gas-powered electricity. In general, the technology is highly energy inefficient and generates its own emissions.

Due to the high energy needs of the process and the significant infrastructure buildout required, CCS is one of the most expensive emissions reduction measures (IPCC, 2022). The cost of CCS projects varies depending on a range of factors, such as the concentration of CO2 in the emissions, the scale of the facility and transportation infrastructure, energy costs, and capital costs. The cost of CCS for oil and gas production could be as low as CAD 50 per tonne of carbon captured in the case of natural gas processing or much higher: the cost of the Quest project up to 2021 was about CAD 200 per tonne. Meanwhile, the lowest cost of capturing CO2 from the Boundary Dam project is estimated at CAD 100–120 per tonne.

Thus, most CCS projects in Canada and globally have required heavy government subsidies and support to be economically viable. At the same time, companies are spending very little of their own money on CCS—or on renewable energy: oil and gas companies globally spent less than 1% of their capital expenditures on clean energy investment in 2020 (Gorski & El-Aini, 2022; IEA, 2021a).

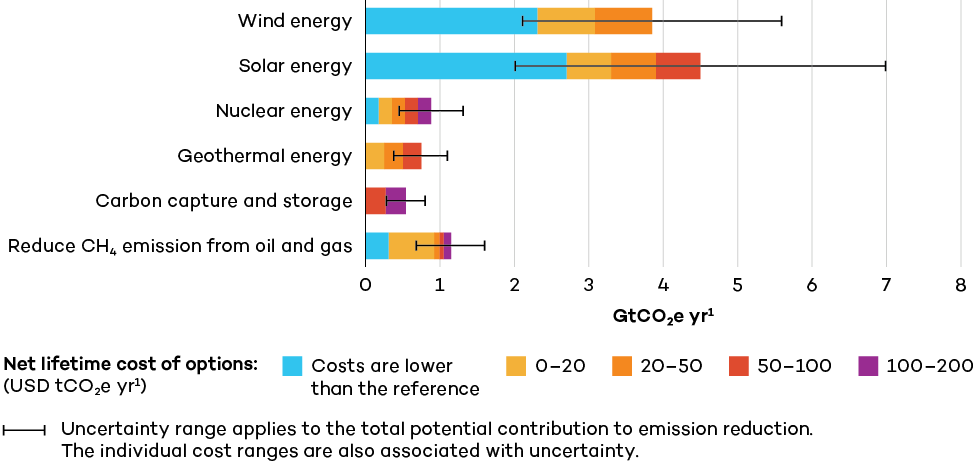

CCS is an expensive approach to decarbonization compared to other measures, such as methane reduction, which is estimated to cost CAD 17 per tonne of greenhouse gas emissions under Canada’s current regulations. As shown in Figure 2, relative to other options for emission reduction options, CCS costs more and is much less effective in lowering emissions.

Figure 2. Cost and potential efficacy of emissions reductions by CCS, methane (CH4) reduction, and renewable energies

Whether the costs of CCS in the oil and gas sector will decline dramatically is a pressing question. The cost of renewable energy technologies (e.g., solar photovoltaic, electric vehicles, and wind turbines) is declining rapidly. In contrast, CCS for gas processing and EOR is a mature technology that has been in development for five decades and is still not delivering comparable cost reductions. Indeed, the costs of CCS may increase as the technology is applied in more complex ways.

CCS projects in the oil and gas industry have benefited from significant financial support from governments in Canada. Most recently, in 2022 the federal government announced a CCS investment tax credit (ITC). While this credit is available for projects in all sectors, it was developed after vocal requests from oil and gas sector representatives. Via the ITC, companies will receive a tax credit at a rate of 50% for carbon capture projects, 60% for direct air capture projects, and 37.5% for carbon transportation, use, and storage projects from 2022 to 2030, with each rate halved from 2031 to 2040. CCS projects eligible for the ITC must plan to operate for at least 20 years. The government estimates the ITC will cost CAD 8.6 billion over the first 8 years and is intended to reduce emissions by 15 MT annually by the end of the decade (Department of Finance Canada, 2021b; Government of Canada, 2022a), for a cost to the public of CAD 100 per tonne of CO2e in 2030. However, the ultimate cost of the ITC will be dictated by industry investment. Considerably more taxpayer dollars could be directed toward CCS if companies scale up commitments.

From 2000 until the establishment of the ITC, government support amounted to at least CAD 5.8 billion: CAD 2 billion from the federal government, CAD 2.6 billion from the Government of Alberta, and CAD 1.2 billion from the Government of Saskatchewan.

Notably, the Boundary Dam project was fully government funded, while the Quest project was 66% covered by public funds. Public funds were also put into projects that never made it to completion, such as the Project Pioneer coal-fired power plant CCS retrofit, which received a total of CAD 779 million from the governments of Alberta and Canada. Oil and gas companies can also receive support for CCS via the Federal Clean Fuel Standard, which provides eligible firms federal tax credits for installing CCS systems that they can then sell, as well as through Crown corporations such as the Business Development Bank of Canada and Export Development Canada.

There is additional potential for further government support for CCS in current funds aimed at reducing industrial emissions, such as the Net Zero Accelerator, the Strategic Innovation Fund to the Clean Resource Innovation Network, the new Green Bond Framework, and the Canada Growth Fund.

The federal government and industry representatives have cited the recent U.S. Inflation Reduction Act (IRA) as a justification for Canada to provide more support to CCS to remain competitive internationally. However, of the USD 369 billion (CAD 499 billion) allocated through the IRA, just USD 3.2 billion (CAD 4.3 billion) was earmarked for the CCS tax credit over the next 10 years. In comparison, Canada’s ITC will provide double that amount (CAD 8.6 billion) by 2030—a significant sum, given the smaller size of the Canadian economy and government spending.

The federal government is prioritizing support for CCS above other decarbonization measures in the oil and gas sector (Table 2). It has provided more resources for CCS than other solutions, such as methane reduction, despite evidence that the latter is one of the most cost-effective ways to cut emissions in the near term and given the government’s own target to cut methane emissions 75% from 2012 levels by 2030. While the government should end all financial support for oil and gas in line with its international commitments, the disproportionate public investment in CCS is particularly inefficient and uneconomical.

At a minimum, the oil and gas sector should be expected to reduce emissions in line with Canada’s national target of 40%–45% below 2005 levels by 2030. But CCS projects are slow to come online, requiring significant infrastructure buildout, including pipelines.

Carbon Capture and Storage Project Timelines and Net-Zero Pathways

Given that CCS is the centrepiece of industry net-zero plans, it is prudent for its credibility to be assessed against Canada’s climate commitments and international criteria for net-zero ambitions.

The United Nations High-Level Expert Group on the Net-Zero Emissions Commitments of Non-State Entities (2022) recently produced a report outlining recommendations for credible net-zero commitments, which include:

- A commitment to no longer invest in new fossil fuel supply

- A focus on reducing absolute emissions rather than emissions intensity

- The inclusion of emissions from all parts of the value chain (scopes 1, 2, and 3)

- Near-term targets for every 5 years

- Alignment with IPCC or IEA net-zero emissions pathways for limiting warming to 1.5°C.

Canada has committed to aiming to limit global warming to 1.5°C, and all credible 1.5°C scenarios show demand for oil and gas peaking in the near term and then declining to mid-century (IEA, 2022; von Kursk et al., 2022).

In this light, the timelines and efficacy of CCS development are not aligned with credible net-zero pathways and near-term emissions reduction targets. At a minimum, the oil and gas sector should be expected to reduce emissions in line with Canada’s national target of 40%–45% below 2005 levels by 2030. But CCS projects are slow to come online, requiring significant infrastructure buildout, including pipelines. Commercial CCS projects in Canada have taken at least 5 years to move from the project announcement to storing carbon. For example, the Boundary Dam CCS project was approved in 2008 but did not come online until 2014. For this reason, the IPCC finds that CCS will not play a significant role in reducing global emissions by 2030 and warns that overreliance on it represents a major risk to climate safety. Similarly, the Canadian Climate Institute (2021) found that it is “highly uncertain” that applying CCS in the fossil fuel sector will reduce emissions significantly before 2030, as it is neither cost-effective nor scalable.

Whether or not CCS is a solution for oil and gas post-2030 needs to be considered in the context of full life-cycle emissions and 1.5°C-compatibility. The rapid decline in global use of oil and gas needed to reach 1.5°C raises serious questions for the long-term compatibility of the sector with these pathways. The IPCC includes 97 pathways to limit warming to 1.5°C that make use of what they determine to be “feasible and sustainable” levels of CCS and CO2 removal, which include very limited reliance on these technologies. Pathways to decarbonize the oil and gas sector should instead prioritize near-term, proven measures and technologies such as energy efficiency, electrification, and methane reduction while planning for an eventual decline in production. If the sector sees a long-term opportunity in decarbonizing production via CCS, they will shift their business models to facilitate this with or without government support, but to date, this has not been the case.

Conclusion: Carbon Capture and Storage is not an effective net-zero solution for Canada’s oil and gas sector

CCS in the oil and gas sector is expensive, energy intensive, unproven at scale, and has no impact on the 80% of oil and gas emissions that result from downstream use. The application of CCS does not align with the time scale or ambition necessary for limiting global warming to 1.5°C—especially given that CCS often facilitates further oil and gas production and use. The scientific consensus and best practices are clear: reducing oil and gas production and use is necessary to limit climate change.

Given the urgency of reducing emissions, instead of supporting CCS, public and private investment should prioritize cost-effective, near-term, and proven solutions to reduce emissions in the oil and gas sector and across the economy. Government should encourage near-term emissions cuts through regulations—such as the methane regulations currently under development—rather than providing further financial support to the oil and gas sector, including for CCS.

The opportunity cost of investing in CCS and the risk of stranded assets for Canada’s oil and gas sector will intensify as global climate ambition ratchets up and demand for oil and gas declines. Ultimately, addressing emissions in the oil and gas sector will be critical in the short term, but scaling up alternative energy systems to allow a smooth shift away from oil and gas production will be essential for long-term, economy-wide decarbonization.

A full list of references can be found here.

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This publication is part six of The Bottom Line policy brief series, which digs into the complex questions that will shape Canada's place in future energy markets.

You might also be interested in

Why Government Support for Decarbonizing Oil and Gas Is a Bad Investment

A close look at the value of government support for decarbonizing Canada's oil and gas sector finds that public dollars are spent more effectively on readily available and proven low-carbon technologies.

Why Canada Is Unlikely to Sell the Last Barrel of Oil

As new technologies and climate policies eat into global demand for oil, this investigation finds that Canadian producers face existential threats that will require bold government policy to diversify the country's economy.

Why Canadian Liquefied Natural Gas Is Not the Answer for the European Union’s Short-Term Energy Needs

This investigation shows that Canadian LNG infrastructure would come too late to address Europe’s energy security needs and offer little benefit to Canada’s economy.

Navigating Energy Transitions: Mapping the road to 1.5°C

This report aims to inform policymakers, investors, and companies on how to align with the goals of the Paris agreement, based on 1.5°C-consistent energy/climate pathways.